what is the inheritance tax rate in virginia

Virginia does not have an inheritance tax. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Creating Racially And Economically Equitable Tax Policy In The South Itep

If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M.

. In the current tax year 202223 no inheritance tax is due on the first 325000 of an estate with 40. How much can you inherit without paying taxes in Virginia. There is no federal inheritance tax but there is a federal estate tax.

With the elimination of. The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption. How much is federal tax on inheritance.

Japan has considerably high inheritance tax rates with the current highest rate standing at 55. Connecticuts estate tax will have a flat rate of 12 percent by 2023. The estate tax rate is 40.

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. When the inherited assets exceed your lifetime exemption of 1206 million. The states with the highest estate tax rates are Hawaii and Washington where the tax ranges from 10 to 20.

But just because Virginia does not have an estate tax does not mean one is not assessed at the federal level. Unlike the federal estate tax where the estate pays the taxes. How much can you inherit without paying taxes in Virginia.

In many states the estate tax ranges from 08 to 16. Price at Jenkins Fenstermaker PLLC by. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

This is great news for Virginia residents. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. A few states have disclosed exemption limits for.

Heres a breakdown of each states inheritance tax rate ranges. To look up a rate for a specific address or in a specific city or county in Virginia use our sales tax rate lookup. The estate tax is a tax on a persons assets after death.

Another states inheritance tax may apply to you if the person leaving you money lived in a. If you expect to inherit an annuity its important to consider beforehand how that. The top estate tax.

No estate tax or inheritance tax. No estate tax or inheritance tax washington. The estate tax was imposed on the transfer of a taxable estate at a rate equal to the maximum amount of the federal credit for state estate taxes as it existed on January 1.

This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381. How is personal property tax calculated on a car in virginia. How much is federal tax on inheritance.

The top estate tax rate is 20 percent exemption threshold. Dividend Tax rate 202122 Dividend Tax rate 202223 Basic. The sales tax rate for most locations in Virginia is 53.

2193 million Washington DC District of Columbia. The rate is determined based on how much money is received by each statutory heir. Today Virginia no longer has an estate tax or inheritance tax.

Virginia Inheritance and Gift Tax. The estate tax is a tax on a persons assets after death. In the letter case the inheritance becomes subject to federal estate taxation with a progressive scale.

The estate tax is a tax on a persons assets after death. The tax rate on an inherited annuity is determined by the tax rate of the person who inherits it.

State By State Estate And Inheritance Tax Rates Everplans

Virginia Tax Payment Amendments Virginia Business Tax

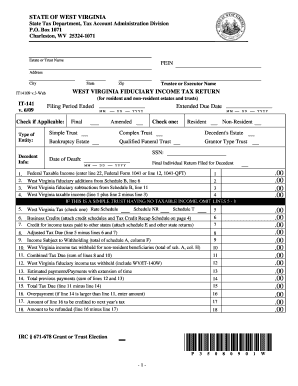

Wv State Tax Department Fiduciary Estate Tax Return Forms Fill Out And Sign Printable Pdf Template Signnow

State Local Tax Assignment Goopenva

Do You Need More Time To File Virginia Tax

Virginia S Individual Income Tax Filing And Payment Deadline Is Monday May 2 2022 Virginia Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxes On Capital Gains Center On Budget And Policy Priorities

/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)

A Brief History Of Taxes In The U S

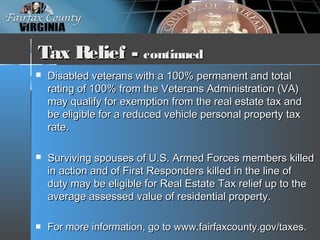

Real Estate Tax Frequently Asked Questions Tax Administration

401 K Inheritance Tax Rules Estate Planning Smartasset

Does Your State Have An Estate Tax Or Inheritance Tax Tax Foundation

Virginia Tax Facts Commonwealth Of Virginia Department Of Taxation Richmond Virginia Pdf Free Download

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is Your Inheritance Considered Taxable Income H R Block

2021 Real Estate Assessments Now Available Average Residential Increase Of 4 25 News Center